Articles >

Steps to Streamline Your Bookkeeping Process

June 05, 2023

In today's fast-paced business world, efficiency is the name of the game. Companies are seeking ways to improve their operations and gain a competitive edge. One area that has seen remarkable improvements in recent years is bookkeeping. By streamlining their bookkeeping, companies have numerous benefits that can significantly impact their business.

One of the key benefits of streamlining bookkeeping work is enhanced accuracy. Traditional bookkeeping methods were often vulnerable to errors and miscalculations, leading to financial distinctions and wasted time. However, with the use of advanced software and automated systems, businesses can now eliminate manual data entry and reduce the risk of human error.

Moreover, streamlining bookkeeping helps businesses to save valuable time and resources. From high accuracy and time savings to improved transparency and data-driven decision-making, the benefits are incontestable. Check out the below steps to streamline your bookkeeping work.

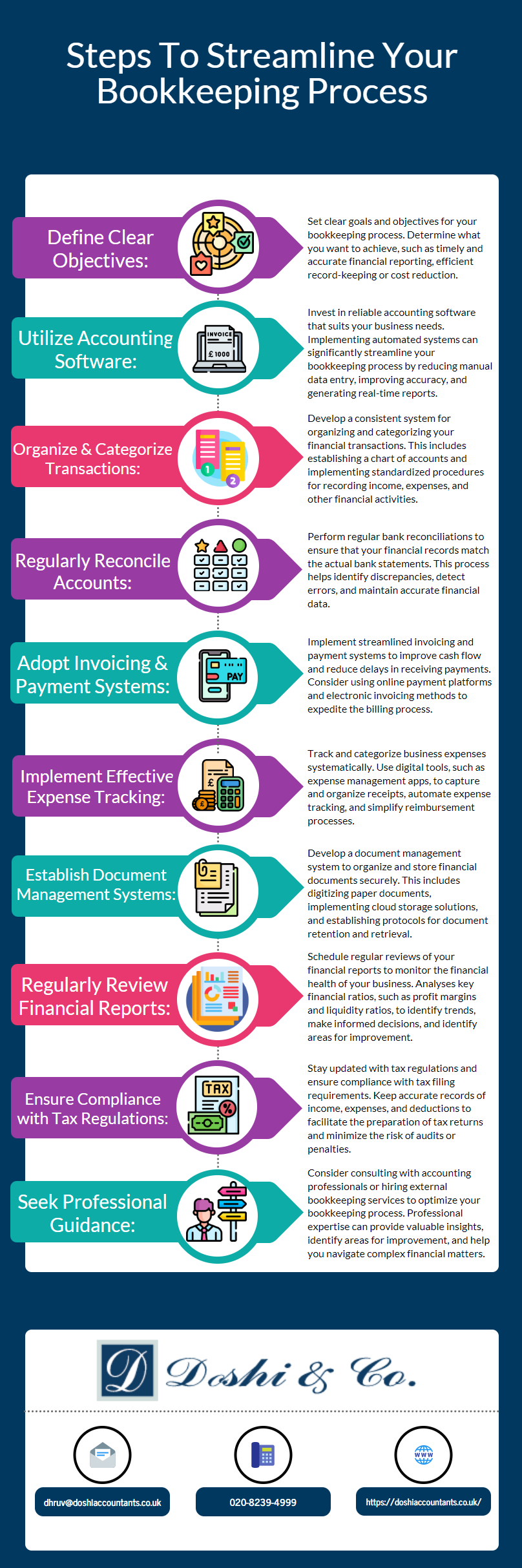

Transcript of The Infographics

1. Define Clear Objectives: Set clear goals and objectives for your bookkeeping process. Determine what you want to achieve, such as timely and accurate financial reporting, efficient record-keeping, or cost reduction.

2. Utilize Accounting Software: Invest in reliable accounting software that suits your business needs. Implementing automated systems can significantly streamline your bookkeeping process by reducing manual data entry, improving accuracy, and generating real-time reports.

3. Organize and Categorize Transactions: Develop a consistent system for organizing and categorizing your financial transactions. This includes establishing a chart of accounts and implementing standardized procedures for recording income, expenses, and other financial activities.

4. Regularly Reconcile Accounts: Perform regular bank reconciliations to ensure that your financial records match the actual bank statements. This process helps identify discrepancies, detect errors, and maintain accurate financial data.

5. Adopt Efficient Invoicing and Payment Systems: Implement streamlined invoicing and payment systems to improve cash flow and reduce delays in receiving payments. Consider using online payment platforms and electronic invoicing methods to expedite the billing process.

6. Implement Effective Expense Tracking: Track and categorize business expenses systematically. Use digital tools like expense management apps to capture and organize receipts, automate expense tracking, and simplify reimbursement processes.

7. Establish Document Management Systems: Develop a document management system to securely organize and store financial documents. This includes digitizing paper documents, implementing cloud storage solutions, and establishing document retention and retrieval protocols.

8. Regularly Review Financial Reports: Schedule regular reviews of your financial reports to monitor the financial health of your business. Analyse key financial ratios, such as profit margins and liquidity ratios, to identify trends, make informed decisions, and identify areas for improvement.

9. Ensure Compliance with Tax Regulations: Stay updated with tax regulations and ensure compliance with tax filing requirements. Keep accurate records of income, expenses, and deductions to facilitate the preparation of tax returns and minimize the risk of audits or penalties.

10. Seek Professional Guidance: Consider consulting with accounting professionals or hiring external bookkeeping services to optimize your bookkeeping process. Professional expertise can provide valuable insights, identify areas for improvement, and help you navigate complex financial matters.